The EMA works well until prices break the fitting line. The problem with the EMA is this: Its prone to price breaks, especially during fast markets and periods of volatility. By this method, an EMA supposed to reduce any lags in the simple moving average so the fitting line will hug prices closer than a simple moving average. The fitting line will hold stronger than an EMA line due to the longer focus on mean prices.Īn EMA is used to capture shorter trend moves, due to the focus on most recent prices. For the simple moving average, a long-term trend can be found and followed much easier than an EMA, with reasonable assumption that The assumption is that prior trend movements will continue. A trend is spotted and extrapolated into a forecast.

The purpose of employing a simple moving average is to spot and measure trends by smoothing the data using the means of several groups of prices. (For a complete guide, read our Moving Average Tutorial.) Signifies a long, while a falling fitting line above the market signifies a Plus, fitting lines tend to remainĬonstant without hint of direction.

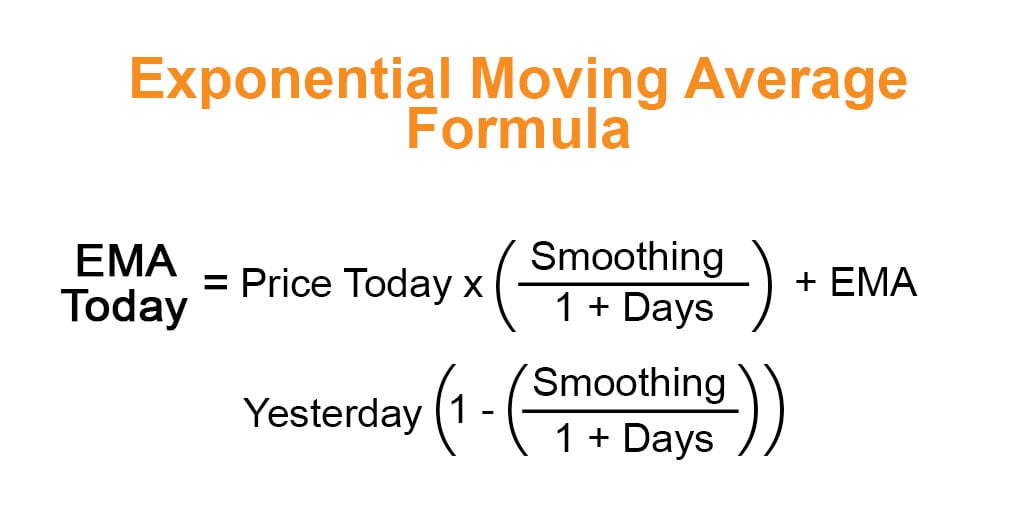

Lack of evident higher highs or lower lows. Periods of congestion because the fitting lines fail to denote a trend due to a They don't work well with range markets and Price signify that all moving averages are lagging indicators, and are used The EMA works by weighting the difference between the current period's price and the previous EMA, andĪdding the result to the previous EMA. This means a 10-period EMA weights the most recent price 18.8%, a 20-day EMA 9.52 % and 50-day EMA 3.92% weight on the most recent day. The important factor is the smoothing constant that = 2/(1+N) where N = the number of days. (For more on how charts are used in currency trading, check out our Chart Basics Walkthrough.)Ĭurrent EMA= ((Price(current) - previous EMA)) X multiplier) + previous EMA. So, a 10-day average is recalculated by adding the new day and dropping the 10th day, and the ninth day is dropped on the second day. This means old days are dropped in favor of new closing price days, so a new calculation is always needed corresponding to the time frame of the average employed. Moving averages are termed "moving" because the group of prices used in the calculation move according to the point on the chart. This formula is not only based on closing prices, but the product is a mean of prices - a subset. The 20-day moving average is calculated by adding the closing prices over a 20-day period and divide by 20, and so on. To calculate a 10-day simple moving average, simply add the closing prices of the last 10 days and divide by 10.

This process was quite tedious, but proved quite profitable with confirmation of further studies. They calculated market prices by hand, and graphed those prices to denote trends and market direction. Early market practitioners operated without the use of the sophisticated chart metrics in use today, so they relied primarily on market prices as their sole guides. Preferred method for tracking market prices because they are quick to calculate and easy to understand. (Would you like a little background reading? Check out Moving Averages: What Are They?) It is generally understood that simple moving averages (SMA) were used long before exponential moving averages (EMA), because EMAs are built on SMA framework and the SMA continuum was more easily understood for plotting and tracking purposes. Charting analysis can be traced back to 18th Century Japan, yet how and when moving averages were first applied to market prices remains a mystery. These are now considered basic methods currently used by technical analysis traders.

#Exponential moving average formula series

Understood, various shaped curves and lines were drawn along the time series in an attempt to predict where the data points might go. Much later, as patterns were developed and correlations discovered. Interpolation, in the form of probability theories and analysis, came Early practitioners of time series analysis were actually more concerned with individual time series numbers than they were with the interpolation of that data. Moving averages are more than the study of a sequence of numbers in successive order.

0 kommentar(er)

0 kommentar(er)